It may be worth paying more over time if the payments are more manageable, even if your repayment period is ultimately longer.

It's not just a matter of the principal, but how long you will maintain the loan and how much interest will accrue over time. Consider your financial situation and how the loan may affect you. Once you conclude the loan comparison phase, it is worth considering which terms are best for you. Closing costs: These are the charges related to finalizing your loan.Commitment fee: This is a fee charged by a lender for future or unused credit.This fee is known as the origination fee. Origination fee : Some lenders charge an upfront fee to process your application.Loan amortization: This is how a loan will be scheduled out into equal payments for the loan's term.Lenders use the DTI to determine your eligibility to borrow money. Debt-to-income ratio (DTI): This figure measures how much of your monthly income is compromised by your debts.Repayment term: The repayment term is the number of months or years it will take to pay off your loan.It includes not only your interest rate but also any other fees charged by your lender. Annual percentage rate (APR) : this figure, expressed as a percentage, represents the true cost of your loan.Loan amount: Sometimes referred to as “the principal”, this is the amount of money you’ll be requesting and receiving from the lender.These loans are designed to help you cover education-related expenses, such as college tuition and fees, books, materials and room and board.īefore applying for a loan, it’s important to understand a few basic concepts, so you can choose the right lending product. Student loans: Student loans can be federal or private.Mortgages can have fixed or adjustable interest rates and repayment terms of up to 30 years. Mortgages: If you’re in the market for a house or a condo, a mortgage is your best financing option.Auto loans have fixed interest rates and are a type of secured loan. Auto loans: These are restricted to the purchase of a vehicle, whether it’s a new or a used model.

These loans typically have fixed interest rates and repayment terms ranging from two to seven years.

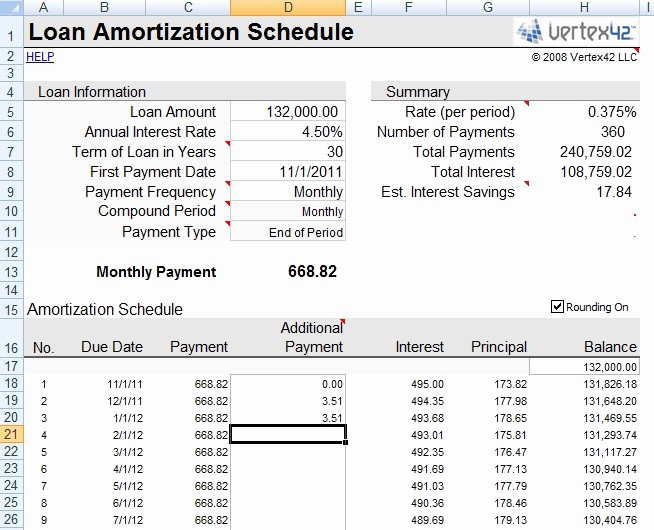

Annual property taxesThe annual amount you expect to pay for property taxes.If you would like to specify these values, select 'No' Let system estimate property taxes, insurance, and private mortgage insurance?Select 'yes' if you want the calculator to estimate these values for you based on national averages.Purchase price of propertyThe selling price of the home you are selling, if applicable.You can control whether you want it to display year-by-year or month-by-month. Desired amortization scheduleAfter clicking Submit, an amortization schedule will be shown.30 years = 360 months, 20 years = 240 months, 15 years = 180 months. Number of months The number of months you wish to finance this home mortgage loan.Annual interest rateThe interest rate for this home mortgage loan.Proposed mortgage loan amountThe amount you wish to borrow for your home mortgage.A mortgage calculator can assist you when buying a home as well. The old adage that the three most important attributes of real estate are "location, location, and location" is worth remembering when you buy a home. The good news is that most people who incur capital gains upon the sale of their personal residences will not have to pay tax on the gains, due to the current exemption limits.

#Best mortgage calculator with amortization plus

Your cost basis will be the principal amount you paid for the property, plus the value of any substantial capital improvements (e.g., building a patio, additional bedroom, etc.) you may have invested in, but not including the cost of ordinary repairs and upkeep. Your capital gain is the amount you sell your home for, minus your cost basis. This increase in value can result in a capital gain to you when you sell your home. Unlike with many other kinds of investments, there are a number of things you can do to increase the investment value of your home.

0 kommentar(er)

0 kommentar(er)